Flood risk is a major concern for prospective homeowners. Flooding can render a house uninhabitable and cause hundreds of thousands of dollars in damage to property and belongings. Additionally, flood insurance is expensive and can significantly increase monthly housing costs.

So, how can homebuyers assess this risk? In this post, we’ll explore why certain areas are more prone to flooding, how to interpret flood probability numbers, where to find reliable information about an area’s flood hazard, and what to consider if your potential property is located in a flood zone.

What Makes an Area Prone to Floods?

There are a range of factors that determine an area’s level of flood risk:

Proximity to Coasts and Bodies of Water can significantly increase the likelihood of flooding. Coastal areas are particularly susceptible to storm surges, high tides, and sea level rise, leading to frequent flooding. Areas near rivers are at risk of riverine flooding when rivers overflow due to heavy rainfall, snowmelt, or dam releases. Similarly, properties near ponds or lakes face increased flood risks if these bodies of water overflow due to large inflows from rain or runoff.

Property Elevation plays a crucial role in flood risk; generally, higher elevations mean lower flood risks as they are less likely to be submerged by rising waters.

Climate also affects flood risk, with areas experiencing heavy rainfall or frequent storms being more prone to flooding.

Soil Saturation Levels are another factor; areas with saturated or poorly draining soil can flood more easily.

Urban Development and Construction Zones can exacerbate flood risks by increasing impervious surfaces, such as concrete, which prevent water from naturally soaking into the ground, leading to more runoff and potential flooding.

Different Types of Flood Zones

The government agency responsible for measuring flood risk in the U.S. is FEMA (Federal Emergency Management Agency). Generally, they categorize areas into three broad zones. Each zone has further types, represented by letters. The first letter indicates the level of flood risk:

High Risk: These zones, also known as Special Flood Hazard Areas (SFHA), have a 1-percent annual chance of flooding. They include types A (typically areas near bodies of water) and V (coastal areas).

Moderate Risk: These areas, often behind levees or in regions with less frequent flooding, have a 0.2-percent annual chance of flooding. The types associated with this category are B and X (shaded).

Minimal Risk: These areas have no or minimal flood risk (less than a 0.2-percent annual chance of flooding) and include the C and X (unshaded) types.

There are also areas with possible but undetermined flood risks, often due to lack of analysis, referred to as D zones.

How to Interpret Flood Probability Numbers

Zones with a high chance of flood have a 1% annual chance of flooding, equating to one flood every 100 years on average. These areas are often referred to as 100-year flood zones. A 1% yearly chance means there’s more than a 1 in 4 chance of being impacted by a flood over a 30-year mortgage:

Probability of at least one flood in 30 years = 1 – (Probability of no flood in 30 years) = 1 − (0.99)30 ≈ 26%

In these zones, homeowners must have flood insurance, and builders must adhere to specific regulations.

Moderate-risk zones have a 0.2% annual chance of flooding, meaning you’d expect a flood once every 500 years on average. As a result, they are sometimes referred to as 500-year flood zones. While this probability may sound tiny, consider the likelihood over a 30-year mortgage:

Probability of at least one flood in 30 years = 1 – (Probability of no flood in 30 years) = 1 − (0.998)30 ≈ 6%

This is not a negligible probability, so it is recommended that homeowners in moderate-risk areas purchase flood insurance.

Where to Get Information on Flood Zones

As mentioned, FEMA offers information on flood risk. However, their website can be challenging to navigate, and the way the information is presented can be confusing.

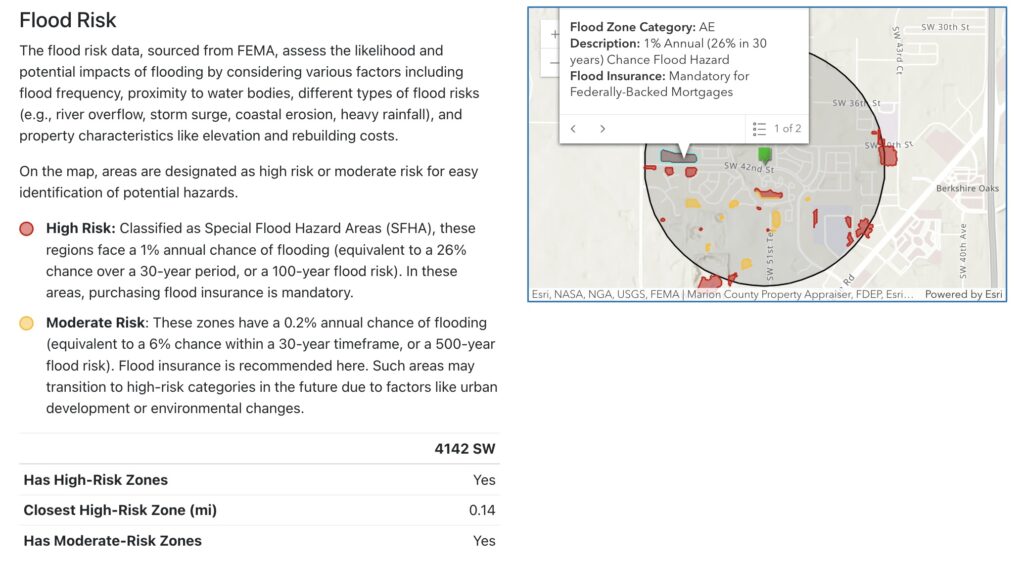

Maptimum provides a slew of essential information on any area in the US, including its flood zones, in a neat and easy-to-understand report, for those researching their potential future locations. To generate a report, enter an address, neighborhood name, zip code, or place of interest and press the “Create Report” button. The “Flood Risk” section of our reports, such as this example for an area in Ocala, FL, clearly indicates whether your designated area includes high-risk or moderate-risk zones, using the most recent data available. Nearby zones and their types are also marked on the map for easier understanding.

Flood Insurance

The cost of flood insurance depends mainly on the degree of risk and the amount of coverage.

The most common coverage for single-family homes is $250,000 for the building and $100,000 for the contents. As of this writing, the average monthly premium is around $50 for low or moderate-risk areas and $80 for high-risk areas.

You can purchase flood insurance from private insurance companies or through the National Flood Insurance Program (NFIP), managed by FEMA.

Effective Mitigation Measures to Protect Your Home

To protect properties from flooding, both local governments and homeowners can implement various flood mitigation measures:

- Levees: Natural or artificial walls that block water from reaching certain areas, protecting them from flooding.

- Sump Pumps: Homeowners can install sump pumps to remove water that accumulates in basements or lower levels, preventing water damage.

- Elevating Electrical Systems: Raising electrical systems above potential flood levels can protect crucial utilities from water damage.

- Landscaping for Better Water Drainage: Creating rain gardens or using porous materials for driveways and walkways can help manage runoff and reduce the risk of flooding.

These measures can significantly reduce the impact of flooding on properties.

Staying Informed and Prepared

Flood hazard is an ever-changing variable influenced by climate change and area development. A location that previously had no risk may become high risk, and vice versa. Therefore, prospective homebuyers must stay informed about an area’s current flood hazard status. Regularly check updated flood maps and reports to ensure you are aware of any changes in flood risk.

Utilize resources such as FEMA’s flood maps and Maptimum’s neighborhood research reports to get detailed and up-to-date information about flood zones. By understanding the probabilities associated with different flood zones and implementing effective flood mitigation, you can make informed decisions and better protect your potential property from flooding risks.